-

Assessment

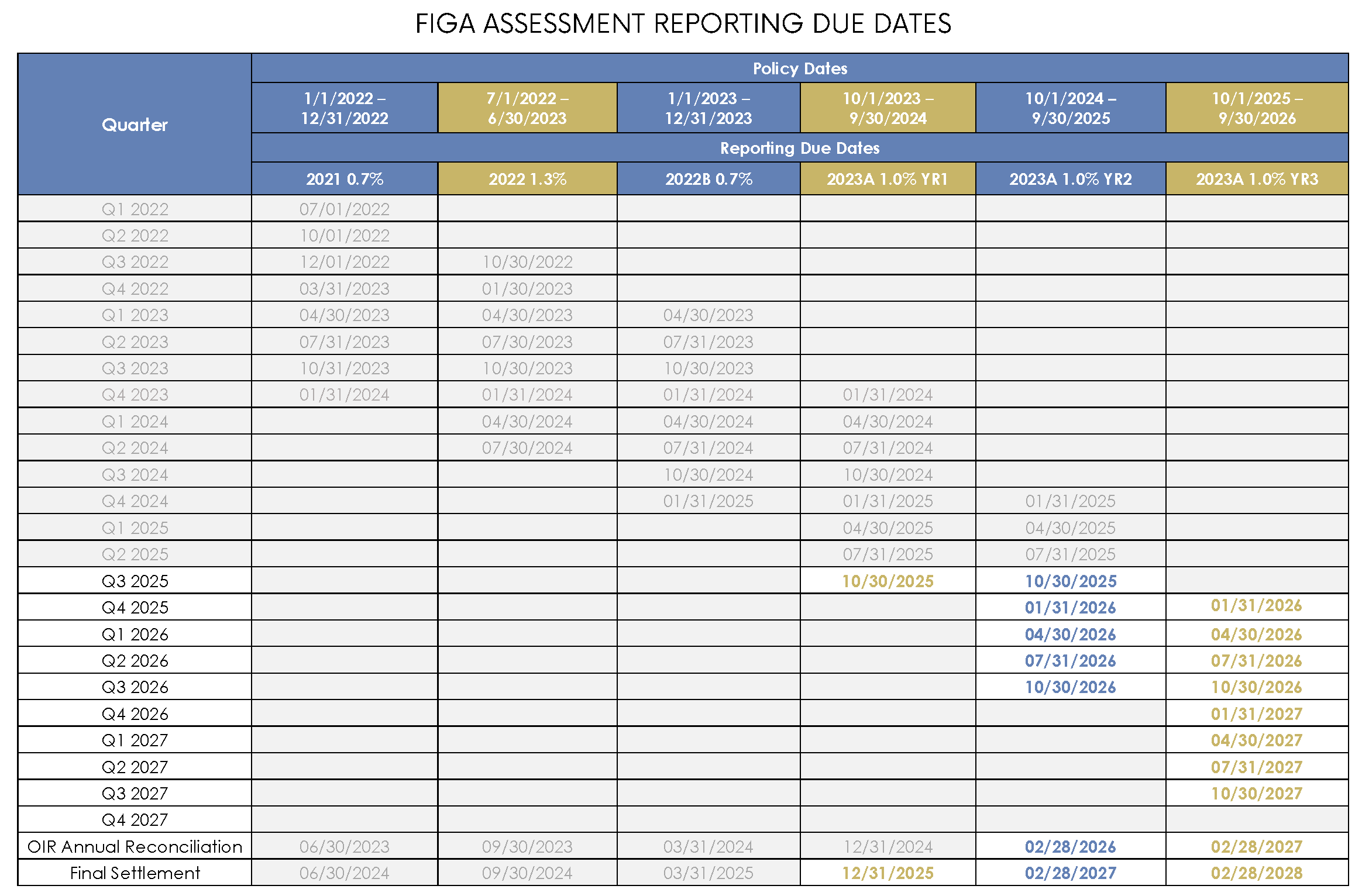

The FIGA Emergency Assessment [2023A - 1%] ends 09/30/2026. Do not collect the assessment for any policies with an effective date after 09/30/2026. For more information, see the news article.

Section 631.52, Florida Statutes, explains the lines of business for which FIGA will pay a covered claim, and therefore the lines of business that are deemed assessable. Section 631.55, Florida Statutes, further divides FIGA into two separate accounts (Auto and All Other) for the purpose of assessment. All current Assessments are only for FIGA’s All Other Account and include the following lines of business:

- Aircraft

- Boiler & Machinery

- Burglary & Theft

- Commercial Multi-peril, Liability and Property (Non-Auto)

- Farm Owners, Private Crop

- Fire, Allied, Earthquake, Homeowners, Personal Liability

- Inland Marine, Pet, Watercraft

- Medical Malpractice

- Product Liability

- Private Flood

Exhibit A: Assessable Lines of Business (“LOB”) by Annual Statement Line Number

further details assessable premiums written for FIGA’s All Other Account.FIGA’s assessments are computed and billed based on the immediate needs of the guaranty association that has claims it needs to pay. Claim files come in from the insolvent insurance company; the adjusters review them, and set appropriate reserves on those files. (Reserves are the projected ultimate liability under terms of a given policy.) In Florida the assessment cap is 2% of net direct-written premium for regular assessments and an additional 2% for emergency assessments for insolvencies relating to hurricanes. FIGA cannot assess an insurance company more than the statutorily set cap on assessments.

That determination is ultimately up to the FIGA Board and is based on current and future cash needs for each of the Auto or All Other Account. Based on our current cash needs for the All Other Account, a pass-through method will be used for both FIGA’s 2021, 2022, and 2023 Emergency Assessments. Members will first collect a premium surcharge from their policyholders and then remit amounts collected to FIGA.

Surcharges are applied on a policy year basis for policies beginning during the Assessment Year.

OIR orders for the 2021 (.70%) and 2022 (1.3%) assessments indicate that “Member insurers shall first collect, and then remit to FIGA, the assessments levied in this Order on a quarterly basis.” The OIR order for the 2022B (.70%) assessment indicates “Members shall either: A. first collect, and then remit to FIGA, the assessments levied in this Order on a quarterly basis….or B. make the quarterly payments referenced above, in 5.A., to FIGA equal to the amount of premium written in the previous quarter for the All Other Account multiplied by 0.7% if the member insurers elect not to recoup the assessment.”

Section 631.64, Florida Statutes, explains disclosure requirements for FIGA assessments. Members are to separately show assessment surcharge on “premium statements to enable policyholders to determine amount charged for association assessments”. Most members plan to show the assessment surcharge as one line item on the declaration page. Our recommendation is to show the amount charged on the Declaration Page as “FIGA Assessment Surcharge”.

For 2022, the assessment surcharge was calculated as 1.3% multiplied by direct written premium for new or renewal policies with term effective dates beginning July 1, 2022, through June 30, 2023 (Assessment Year). MGA, EMPA, and other policy fees were not assessable. For 2021, the assessment surcharge was calculated as 0.7% multiplied by direct written premium for new or renewal policies with term effective dates beginning January 1, 2022, through December 31, 2022 (Assessment Year). MGA, EMPA, and other policy fees were not assessable.

The order establishing the assessment instructs members to apply a policy surcharge to All Other Account policies during the Assessment Year. FIGA recommends that members apply the missing surcharge when the policy is subsequently updated or endorsed during the Assessment Year.

Section 631.57 (3)(g), Florida Statutes, explains that members shall treat the failure to pay the surcharge the same as if the policyholder failed to pay their premium.

No. Assessments levied by FIGA are not premium and are not subject to premium taxes, any policy fees, other taxes or commission.

Members can remit surcharge payments to FIGA by check, Wire, or ACH.

When remitting via check, make checks payable and mail to:

Florida Insurance Guaranty Association, Inc.

P.O. Box 14249

Tallahassee, FL 32317When remitting via wire or ACH transfer:

Wire and ACH information can be obtained from the QSR and ASR forms or by emailing assessments@agfgroup.org. When remitting surcharge payments via wire or ACH transfer, please include the NAIC number and company name in the payment remittance details. If remitting one payment for multiple companies in a group, please provide the NAIC number and surcharge amount for each company on the check remittance documentation or in the wire/ACH payment remittance details, in order to ensure that payments are received and applied correctly.Click here to obtain FIGA's W-9 Form.

Yes. Members are still required to submit the initial remittance form [a zero report] and the annual reconciliation even if they do not write assessable lines of business. Per the note on the quarterly remittance form, we will suspend subsequent quarterly reporting once we’ve received and processed the initial filing and have been contacted by the company to do so in writing. Those requests can be sent to assessments@agfgroup.org.

Yes, but they should provide the NAIC number and assessment amount for each company included in the group, either on the check remittance documentation or in the wire payment detail fields.

Member companies will only remit surcharge amounts collected from policyholders, and will be given the opportunity to “true-up” or reconcile amounts following the Assessment Year.

Our recommendation is to round assessment surcharge similar to other premium amounts listed on the declaration page of the policy.

To update member representative contact information, please send your request to Assessments@agfgroup.org. Please include the company name, individual representative name, and contact information in your request.

Members can reach a FIGA representative at (850) 386-9200, or they can submit their questions via email to Assessments@agfgroup.org.

Assessments are applied to admitted policies only.

The assessments are additive.

Assessment Levy Assessment Year Start Date End Date 2021 Assessment .70% 1/1/2022 12/31/2022 2022A Assessment 1.3% 7/1/2022 6/30/2023 2022B Assessment .70% 1/1/2023 12/31/2023 When you combine all three, policyholders should be surcharged the following rates for new policies issued or renewed starting:

1/1/2022 – 6/30/2022 => 0.70%

7/1/2022 – 6/30/2023 => 2.00%

7/1/2023 – 12/31/2023 => 0.70%No, the assessment is based on the effective date of the policy. The effective date in this example is 8/1/2021 and therefore the assessment does not apply. If the effective date was 8/1/2022 through 8/1/2024, then the assessment would apply to the entire amount of the policy premium for the multi-year term.

No, the FIGA assessment is not considered a sales tax.

Yes. The assessment applies to endorsements that are made to policies with an effective date within the assessment year.

No.

No – the assessment is based on a policy year, and the annual report is based on a calendar year.

Your company is receiving a remittance document because, according to the Office of Insurance Regulation, it is authorized to write one or more of the assessable lines in the State of Florida, and therefore must report an initial filing even if it is zero. If it is zero and the company will not write any of the assessable lines in the future, FIGA will suspend the quarterly reporting once the initial filing is received and processed, and it receives a request for that suspension in writing via email to Assessments@agfgroup.org. Those instructions are also indicated on the Quarterly Surcharge Remittance documents.

NO. The remittance document must be submitted via DocuSign in order for it to be processed and for any surcharge payment received to be properly applied to the appropriate company. Detailed instructions on reporting can be found in the FIGA Quarterly Surcharge Remittance Reporting Guide.

Yes. Reporting is still required even if it is zero.

Send an email requesting the contact update to Assessments@agfgroup.org, including the new contact’s full name and email address. The remittance document will then be re-routed to the new contact’s email address. Any additional updates that may be needed (name, phone number, address, title, etc.) must be entered on the actual form in order for a permanent update to occur in FIGA’s system records. Once FIGA has received and processed the remittance document, the system will automatically update the contact information, and all future remittances will be sent to the new contact.

NO, but the assigned contact can download or print the remittance document and then forward a copy to anyone they choose. The document can also be reassigned to a different contact by the original signer if someone else is responsible for completing and signing it. Instructions on assigning the remittance document to someone else can be found in the FIGA Quarterly Surcharge Remittance Reporting Guide.

Suspension of subsequent reporting after the initial filing only applies to the quarterly reporting. Remittance of the Annual Surcharge Reconciliation Affidavit [ASR] is required as it serves as a true-up of what has been previously reported. The ASR affidavit will combine data submitted in prior reports for members to update and or confirm policyholder surcharges reported and collected during the Assessment period.

That decision is up to each member company to determine; FIGA has no preference regarding who signs the remittance document.

Send an email to Assessments@agfgroup.org for formal verification of the banking information.

Send an email to Assessments@agfgroup.org so FIGA can research whether the company is subject to the Assessment and/or whether it was incorrectly excluded from the distribution.

The W-9 (Request for Taxpayer Identification Number and Certification form) can be downloaded from the figafacts.com website via the following link: W-9 Form

Only the person assigned to the remittance document distributed via DocuSign can view, download, and print it with what has been entered. When the document is assigned or forwarded to another person, any data entered by the original signer will not be saved and therefore the document will be blank.

FIGA is part of a nonprofit system created by state law to protect consumers from insurance company insolvencies (when a company does not have enough money to pay all its debts and policyholders’ claims). By paying valid outstanding claims of those property and casualty insurance companies, FIGA protects consumers. It eases the burden on policyholders and claimants by immediately stepping in to assume responsibility for most policy claims following liquidation, ensuring that their claims and payments are covered to the full value up to the limits set by their insurance policy or state law. FIGA provides two important benefits to consumers: prompt payment of covered claims, and payment of the full value of covered claims up to the limits set by the policy or state law.

FIGA is also responsible for providing consumers with a pro-rated refund of the amount paid for the remainder of their policy post cancellation. For example, if a consumer pays for a year of coverage and the policy cancellation date is 3 months later due to a member insolvency, FIGA will refund the consumer 75% of the payment.

Guaranty associations ease the burden on policyholders and claimants of the insolvent insurer by immediately stepping in to assume responsibility for most policy claims following liquidation. The coverage guaranty associations provide is determined by the insurance policy or state law; they do not offer a “replacement policy.” By virtue of the authority given to the guaranty associations by state law, they are able to provide two important benefits: prompt payment of covered claims and payment of the full value of covered claims up to the limits set by the policy or state law.

FIGA falls under the oversight authority of the Florida Department of Financial Services, a state agency under the state Chief Financial Officer (CFO). FIGA is administered by a board elected by its member companies, plus an additional board member appointed by the CFO. The Florida Department of Financial Services reviews FIGA’s plan of operation, and may audit the association.

While many of the associations are based on a model set forth by the National Association of Insurance Commissioners (NAIC), there are differences in statutes that govern the associations and their operation from state to state, including the amount of coverage provided by the association.

The potential failure of insurance companies, like the potential failure of all businesses, is an unfortunate, but inevitable, part of doing business in a free-market system. Since inception of the property and casualty guaranty association system, there have been about 600 insolvencies. In all, the system has paid out about $24.2 billion.

Liquidation is similar to bankruptcy. When a company is liquidated, a Receiver collects its assets and determines its liabilities, including pending claim payments and unpaid bills. The Receiver then develops a plan to distribute the company’s assets according to the law and submits this plan to a court for approval. In most cases, the company doesn’t have sufficient remaining assets to promptly pay claims in full, and that’s when FIGA steps in to cover valid policyholder claims as quickly as possible.

Yes. Most liquidation orders cancel all policies within a certain time period after liquidation, typically 30 days. You will need to obtain coverage with another insurance company. However, we do not recommend any particular company. You may contact any licensed insurance agent to get the names of other insurers. For homeowner’s insurance information in the State of Florida, you may contact the Florida Market Assistance Plan at 800-524-9023.

FIGA will process and pay pending covered claims, subject to the lesser of policy limits or FIGA’s maximum cap (see "Are there limits on the amount that FIGA will pay?" above). For information on the status of your claim, you may contact the Florida Insurance Guaranty Association (FIGA) at:

PO Box 14249

Tallahassee, Florida 32317

(800) 988-1450 Toll Free

(850) 523-1888 FAXUnder the FIGA statute (F.S.631.54), "covered claim" refers to a type of claim that can be made on an insurance policy that was issued by a property and casualty insurer that has become insolvent. FIGA steps in to protect policyholders regarding those claims that are eligible for. Covered claims include the amount of unpaid claims that fall within the coverage limits of the original insurance policy, subject to the statutory limits set by Florida law. FIGA's coverage may have maximum limits, meaning that not all policy benefits or claim amounts may be fully covered if they exceed these statutory caps. This system aims to ensure that consumers are protected to a reasonable extent from the financial fallout of an insurer's insolvency, maintaining confidence in the insurance market.

Yes. If your insurance company has been declared insolvent, FIGA will pay covered claims up to a maximum amount of $300,000, with special limits applying to (1) damages to structure and contents on homeowners’ claims and (2) condominium and homeowners’ association claims. For damages to structure and contents on homeowners’ claims, the FIGA cap is an additional $200,000. For condominium and homeowners’ association claims, the cap will be either the limits specified in the policy or $200,000 multiplied by the number of units in the association, whichever is less. No claim will be paid in excess of this cap. All claims for companies liquidated prior to July 1, 2021, are subject to a $100 FIGA deductible in addition to any deductible identified in the policy. You may file a claim against the assets of the insurance company estate for the $100 deductible and for amounts over the cap; the Receiver will send proof of claim forms and instructions for filing a claim. The Florida Legislature passed a law to remove the $100 FIGA deductible on any claim received from companies liquidated on or after July 1, 2021. Claims not covered by FIGA may be claims against the remaining assets (estate) of the insurance company and will be considered by the Receiver after all covered claims have been processed.

It varies, but claim payments usually begin as soon as possible once a company is ordered liquidated. FIGA, coordinating with the receivers of the liquidating companies, works hard to avoid delays, but it is not uncommon for payments to take 30-60 days after the order of liquidation.

No. FIGA is designed as a safety net to pay certain claims arising out of policies issued by licensed insurance companies. FIGA does not pay non-policy claims or claims of self-insured groups, or of other entities that are exempt from participation in the guaranty association system. FIGA coverage is limited to licensed insurers (the members of the guaranty associations that, in turn, pay insolvency-related assessments). When a licensed insurance company becomes insolvent, FIGA pays eligible claims – but a company does not have guaranty association coverage if it is writing non-admitted or unlicensed products, such as surplus lines, or is a self-insurer covered in the non-admitted market. These limits on guaranty association coverage are necessary to balance the need to provide a safety net to those who would be most harmed by the insolvency of their insurance company and keep the burden of providing the safety net at an acceptable level.

- As soon as possible, report damage to your insurance agent or FIGA, even if the cause of the damage is unknown.

- Make temporary repairs to prevent further damage, and remember to keep receipts for any supplies necessary for those repairs.

- Save damaged items until an adjuster inspects them; additionally, take pictures and/or video, if possible, of all damages and damaged items.

- Make your property easily identifiable by displaying the house address and insurance company name.

- Seek long-term shelter if the property is uninhabitable and has sustained major damage. Reasonable expenses are generally reimbursed; the limits of your policy may determine your “Loss of Use” coverage.

- Be patient – after disasters, especially larger ones, the company’s immediate response time may be longer than usual.

- Prepare an inventory with receipts or other evidence of value and ownership, as necessary, to assist in the claim settlement process.

- For smaller losses, start getting repair estimates, if possible.

- If you disagree with the settlement offer, you may elect mediation or arbitration; however, first try to negotiate with the adjuster or company.

Yes. Once you have filed a claim, you will receive a form from the Receiver called a Proof of Claim form. In order for your claim to be considered by the Receiver, you must complete the form and return it to the Receiver by the filing deadline.

You should contact FIGA immediately at 1 (800) 988-1450 to determine whether you are entitled to receive a legal defense just as the insurance company would have done if it were still in business. You will need to cooperate with FIGA and the defense counsel, just as you would have done with your company.

Your policy controls what is covered, so consult it to determine whether these expenses will be covered. Generally, voluntary evacuation expenses are not covered by your insurance policy, and only under certain conditions will mandatory evacuation expenses be covered.

If following a covered loss, your home is deemed uninhabitable due to a covered loss and you must move, or if a civil authority prevents access to your home, the Additional Living Expense (ALE) provision of your homeowner’s policy may pay reasonable additional expenses (your policy controls this). Consult your policy to determine this coverage.

Most policies will pay for food spoilage when the interruption of power is caused by direct damage to the insured home, but not if the power goes out in the general area.

Replacement cost coverage is triggered when you actually replace the item. The insurer will initially pay the depreciated value (ACV), and then will pay the difference between that amount and the replacement cost when you provide evidence that the items have been replaced. This applies to both the structure and its contents. Some companies will release a replacement cost payment for the dwelling when you produce a signed repair contract from a licensed contractor. In the case of the dwelling being a total loss, the structure portion of the claim is usually paid in full.

In most insurance policies, the removal of a tree and its debris is generally limited to $500 per tree and a maximum payout of $1,000 for the entire property. Further, this generally applies only if a covered structure (house, fence, utility building, etc.) is damaged, or if the tree blocks driveway access or a ramp that provides disability access.

Since policies vary, you should review your coverage with your insurance agent. Generally, condo associations may assess individual units for damage to common areas that aren’t covered by the association’s insurance policy. Your unit owner’s policy may provide limited coverage. The standard ISO homeowners program does cover an assessment for an association deductible, but only up to $1,000. This is the case even if the policy has been endorsed to provide loss assessment coverage above the built-in $1,000 limit. Damage must be to covered property due to a covered peril.

Yes. FIGA provides property and casualty coverage up to $300,000 for non-residential commercial policies.

Yes. For policies covering condominium or homeowners’ associations that have a responsibility to provide insurance coverage on residential units within the association, FIGA will cover an amount up to $200,000 multiplied by the number of condominium units or other residential units. However, regarding homeowners’ associations, this applies only to claims for damage or loss to residential units and structures attached to residential units.

If your auto policy includes comprehensive coverage (a.k.a. “Other than Collision”) at the time of a disaster, then wind and flood damages are covered. For example, auto glass broken by windblown objects, vehicles overturned by the force of the wind, or auto glass that pops out due to a sudden drop in atmospheric pressure are generally all considered covered losses. Windshield glass claims are subject to the statutory deductible but not to your comprehensive deductible.

Homeowner’s insurance hurricane deductibles are determined by each insured’s dwelling value, as stated in Coverage A. For most homes, deductibles can range from a minimum of $250 to a maximum of 10% of the home’s value. Individual policies have different deductibles, different coverages, and different specific amounts. You must read your policy to determine more precise answers.

All medical invoices should be mailed to:

Florida Insurance Guaranty Association

PO Box 14249

Tallahassee, FL 32317“Unearned Premiums” refers to money you have already paid for your insurance policy – for example, if you pay a full-year premium in advance – but the insurance company hasn’t “earned” it because it has not yet provided coverage for the full year. If your insurance company becomes insolvent before the full year, FIGA will pay claims for these unearned premiums after the Receiver completes its processing of the policy records and sends the unearned premium record to FIGA. This may take several weeks or several months, depending on the condition of the data maintained by the insolvent insurance company.

FIGA will pay unearned premium claims for covered lines of business after the Florida Receiver completes its processing of policy records and sends the unearned premium records to FIGA. Policyholders will be refunded only for the portion of unearned premiums collected by the insolvent company.

No, the Receiver deems claims for unearned premiums as automatically filed, so no action is required by the policyholder. FIGA will process return premium payments after receiving policy information from the Receiver, which is typically delivered after the policy cancellation date.

There are many reasons why you may need to change a name and/or address on a check. Please review all the instructions carefully that are outlined below and that are included on the appropriate form(s). This includes instructions for completing the form(s) and instructions outlining what supporting documentation is required based on the reason for your change request. All completed forms and supporting documentation should be submitted to FIGA in one of the following ways:

Electronic Submission (preferable):

Submit your completed form(s) & supporting documentation via Email using the instructions below:-

- Enter the following Email in the “To” field: checkprocessing@agfgroup.org

- Enter the following in the “Subject” field: Name/Address Change Request

- Attach your documents

Paper Submission:

Include your completed form(s) and supporting documentation, and mail to:-

- Florida Insurance Guaranty Association

P. O. Box 14249 | Tallahassee, Florida 32317

- Florida Insurance Guaranty Association

FIGA reserves the right to validate any name and/or address change request received and may request additional information from you.

If you are requesting an address change only, please click here:

FIGA Address Change Only Request FormIf you are requesting a name change, with or without an address change, please click here:

FIGA Name Change Request Form With or Without Address Change

Estate Affidavit for NAME/ADDRESS Change Request-

After an order of liquidation is entered by the Court, the Receiver assumes responsibility for marshalling all the insolvent company’s assets, liquidating them, and recommending to the Court payment of liabilities as those assets allow. In Florida, the Receiver is the Florida Department of Financial Services. All “covered claims,” which are amounts payable under an insurance policy of an insolvent company (see complete definition in Florida Statute 631.54 (4)), are transferred to FIGA for the express purpose of avoiding excessive delay in payments to claimants or policyholders (Florida Statute 631.51). Therefore, FIGA is not responsible for outstanding invoices from service providers or vendors, as these liabilities of the insolvent entity are not “covered claims” under the statute.

However, you are not without recourse, as these outstanding invoices will be evaluated for payment by the Receiver. If you provided goods or services to the insolvent company prior to the date of liquidation, you should contact the Receiver for additional instructions. Generally, the Receiver requires a listing of outstanding amounts owed, along with a description of the services provided, so that the request can be fairly evaluated. You will need to submit a Proof of Claim, which can be obtained through the Receiver’s office. For a Florida insolvency, you may find the website http://www.myfloridacfo.com/Division/Receiver/ to be helpful. You should not continue to provide services after the date of liquidation with the expectation of being paid by FIGA without FIGA’s express written permission. FIGA’s statutory authority is to pay claims and to retain persons necessary to handle those claims. FIGA has no statutory authority to pay expenses incurred prior to the liquidation, as they are not "Covered Claims" – these are the responsibility of the estate and will be evaluated by the Receiver for payment in accordance with Florida Statute 631.271 and under the supervision of the Court.

Frequently Asked Questions

General

Claims

Unearned Premium

Pre-Liquidation Vendors