2026 FIGA Assessment Update

CRITICALLY IMPORTANT INFORMATION

The multi-year emergency assessment [ 2023A – 1% ] will end on 9/30/2026. New and Renewal policies effective 10/1/2026 and forward should not reflect the FIGA 1% assessment.

Please make the necessary adjustments to your policy processes so the FIGA assessment is no longer collected on policies with an effective date after 9/30/2026.

FIGA will continue to collect the emergency assessment on policies with effective dates through 9/30/2026. Quarterly reporting, as well as the annual reconciliation filings, will remain in place until a final reconciliation for premiums has been completed in February 2028.

We ask you forward this notice to all parties involved with FIGA processing and reporting. If you have any questions, please contact us directly at assessments@agfgroup.org or (800) 988-1450.

2025 FIGA Assessment Update

THE MULTI-YEAR EMERGENCY ASSESSMENT (2023A 1.0%) FIRST LEVIED ON 04.10.2023, WILL CONTINUE AS PLANNED.

This multi-year continuous assessment will remain in place until all of the Series 2023A Bonds are repaid in full. YEAR 3 OF THE ASSESSMENT WILL COVER ALL POLICIES WITH AN EFFECTIVE OR RENEWAL DATE BETWEEN 10.01.2025 AND 09.30.2026.

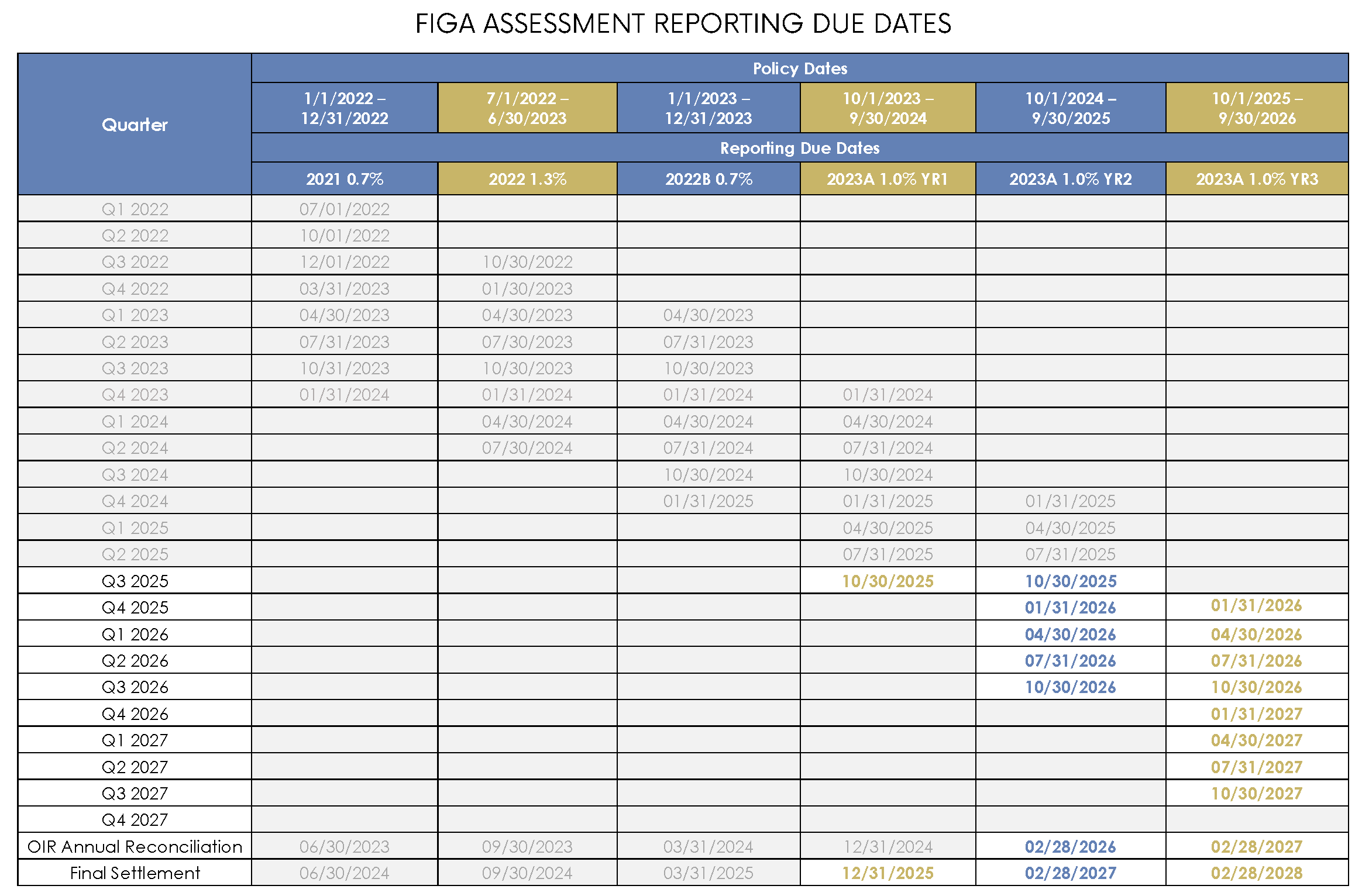

This assessment year will be designated 2023A 1.0% YR3, with subsequent years following the same naming convention. Beginning 01.01.2026, DocuSign forms will provide separate reporting lines for Year 1, Year 2 and Year 3. See below for an updated reporting schedule.

We ask that you forward this notice to all parties involved for the necessary programming and process changes in order to ensure timely collection and reporting.

2024 FIGA Assessment Update

The multi-year Emergency Assessment (2023A 1.0%) first levied on 04.10.2023, will continue as planned.

This multi-year continuous assessment will remain in place until all of the Series 2023A Bonds are repaid in full. Year 2 of the assessment will cover all policies with an effective or renewal date between 10.01.2024 and 09.30.2025.

This assessment year will be designated 2023A 1.0% YR2, with subsequent years following the same naming convention. Beginning 01.01.2025, DocuSign forms will provide separate reporting lines for Year 1 and Year 2. For more detailed information and updates, feel free to reach out to us directly at Assessments@agfgroup.org or (800)988-1450.

Thank you for your continued support, and please do not hesitate to contact us if you have any questions or require further assistance.

FIGA Assessment Update

On December 11, 2023, the FIGA Board of Directors met and discussed future assessment needs. The Board determined the emergency Assessment [2023A] will continue as planned, but no regular assessment is needed at this point in time.

If you have any further questions, please do not hesitate to contact us at (866) 909-9200 or send us a comment at https://figafacts.com/.

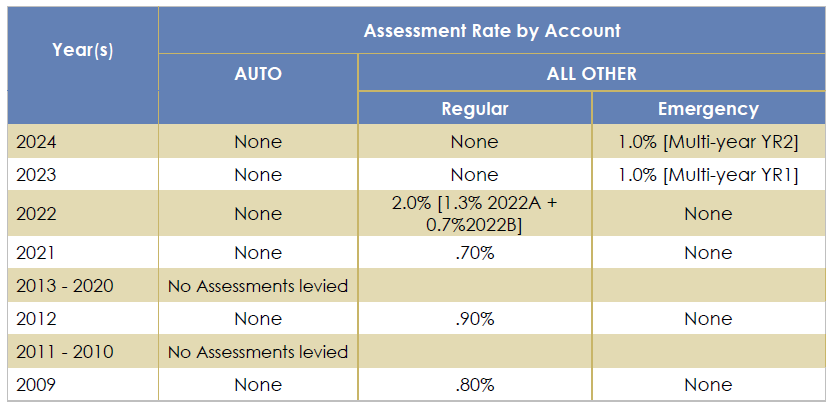

The following chart shows the fifteen (15) year history of prior assessment levies in descending order by carrier type. Please note that although no assessments were levied in 2024, Year 2 of the 2023 1.0% continuous assessment levy will cover all policies with an effective or renewal date between 10.01.2024 and 09.30.2025 with subsequent years [Year 3, Year 4, etc.] following until all of the Series 2023A Bonds are repaid in full.

2023 FIGA Assessment Update

Update: See OIR’s Order to levy 2023 FIGA Emergency Assessment for All Other Account.

On March 31, 2023, the FIGA Board of Directors approved a 1% emergency assessment on its members. FIGA’s emergency assessment is necessary to secure funds for the payment of covered claims relating to the liquidation of United Property & Casualty Insurance Company.

On April 10, 2023, The Florida Office of Insurance Regulation levied a 1% emergency assessment on all covered lines of business except auto pursuant to Section 631.55 (2)(b), Florida Statutes. Member insurers will collect then remit assessments to FIGA on a quarterly basis as per Section 631.57(3)(f)2, Florida Statutes. FIGA members will be able to recoup the 1% emergency assessment from their policyholders over the Assessment Year starting October 1, 2023 through September 30, 2024 and continuing until the bonds have been paid in full. FIGA will send a notice to all Member Insurers on or before June 30 of the final Assessment Year in which the Bonds will have been repaid in full and are no longer outstanding, informing Member Insurers that they may end collection of the 1% emergency assessment on September 30 of that final Assessment Year.

A public workshop was held on July 25, 2023 to provide members with information on how to report and remit surcharges collected for the 2023 Assessment. The presentation for the workshop is available below.

FIGA Assessment Workshop [held 7/25/2023]

2022 FIGA 1.3% Assessment Surcharge Payment Remittance Update

We received several notifications from members that the ACH instructions to the FIGA Trust Account for the 1.3% assessment are not transmitting. Due to the issues members have experienced, we have determined that effective immediately, all payments for all FIGA assessments will need to go through the FIGA Wells Fargo Account. We apologize for any inconvenience this has caused.

When remitting surcharge payments via WIRE or ACH transfer, please include the NAIC number COMPANY NAME in the payment remittance details. If remitting one payment for multiple companies in a group please provide the NAIC number SURCHARGE AMOUNT for each company on the check remittance documentation or in the wire/ACH payment remittance details to ensure payments are received and applied correctly.

2022B FIGA Assessment Update

Update: See OIR’s Order to levy 2022B FIGA Assessment for All Other Account.

On August 19, 2022, the FIGA Board of Directors approved a .70% assessment on its members. FIGA’s new assessment is necessary to secure funds for the payment of covered claims relating to the liquidation of Southern Fidelity Insurance Company and Weston Property and Casualty Insurance Company.

On August 26, 2022, The Florida Office of Insurance Regulation levied a .70% assessment on all covered lines of business except auto pursuant to Section 631.55 (2)(b), Florida Statutes. Member insurers will collect then remit assessments to FIGA on a quarterly basis as per Section 631.57(3)(f)2, Florida Statutes. FIGA members will be able to recoup the .70% assessment from their policyholders over the Assessment Year starting January 1, 2023 through December 31, 2023.

This assessment is in addition to FIGA’s 1.3% assessment levied by Florida Office of Insurance Regulations back on March 11, 2022.

A public workshop will be held on September 21 by FIGA to provide members with information on how to report and remit surcharges collected for the 2022 Assessments. The presentation will be uploaded to the website subsequent to the workshop.

FIGA Assessment Workshop [held 9/21/2022]

2022 Assessment Update

Update: See OIR’s Order to levy 2022 FIGA Assessment for All Other Account.

On March 8, 2022, the FIGA Board of Directors approved a 1.3% assessment on its members. FIGA’s new assessment is necessary to secure funds for the payment of covered claims relating to the liquidation of St. Johns Insurance Company.

On March 11, 2022, The Florida Office of Insurance Regulation levied a 1.3% assessment on all covered lines of business except auto pursuant to Section 631.55 (2)(b), Florida Statutes. Member insurers will collect then remit assessments to FIGA on a quarterly basis as per Section 631.57(3)(f)2, Florida Statutes. FIGA members will be able to recoup the 1.3% assessment from their policyholders over the Assessment Year starting July 1, 2022 through June 30, 2023.

This assessment is in addition to FIGA’s .70% assessment levied by Florida Office of Insurance Regulations back on October 11, 2021.

A public workshop was held March 30, 2022 by FIGA to provide members with information on how to report and remit surcharges collected for the 2021 and 2022 Assessments. This presentation is now available below.

FIGA Assessment Workshop (held 3/30/2022)

2021 Assessment Update

Update: See OIR’s Order to levy 2021 FIGA Assessment for All Other Account

The FIGA Board of Directors certified the need for a 0.70% assessment on its member insurers at its August 26, 2021 meeting. The assessment is necessary to secure funds for the payment of covered claims related to new insolvencies in FIGA’s Other Account.

The Florida Office of Insurance Regulation levied a 0.70% assessment on all covered lines of business except auto pursuant to Section 631.55 (2)(b), Florida Statutes. Member insurers will be required to collect an equivalent surcharge on new and renewal policies with effective dates beginning January 1, 2022 through December 31, 2022. Member insurers will remit surcharge assessments quarterly on or before July 1, 2022, October 1, 2022 and December 1, 2022. Members will remit their final installment for the remaining assessment surcharges collected along with a 2022 direct written premium verification report to FIGA on or before March 31, 2023.

FIGA Assessment Workshop [held 10/18/2021]

Documents & Forms

FIGA Quarterly Surcharge Remittance Reporting Guide

FIGA Assessment FAQ

*FIGA COMBINED Quarterly Surcharge Remittance Sample

*FIGA Quarterly Surcharge Remittance Sample

*FIGA Annual Surcharge Reconciliation Affidavit Sample

[The above are samples and are posted for REFERENCE ONLY. Remittance documents must be submitted via DocuSign to be received and processed.]

Assessment Liability Report

The National Conference of Insurance Guaranty Funds publishes on their website actual and projected assessment information for all P&C guaranty funds by quarter-end. The Assessment Liability Report can be found at https://www.ncigf.org/industry/guaranty-fund-assessment-liability-information/. The Assessment Liability Report includes – by statutory account of each state guaranty fund – the maximum assessment, net assessable premium and actual and projected assessment information.

Additional information about the FIGA assessment process is available in Senate Bill 540 enacted into law on June 20, 2020.